The recent bankruptcy filing of Shapeways, a pioneering force in the 3D printing industry, marks a significant moment for the sector. While Shapeways' downfall might seem alarming, it provides valuable insights into the broader dynamics of the 3D printing service industry.

This analysis examines why some companies continue to thrive while others struggle, offering lessons for the future of additive manufacturing services and what this means for the industry as a whole.

The Rise and Fall of Shapeways

Shapeways, founded in 2007 as a spin-off from Royal Philips Electronics, was a trailblazer in democratizing 3D printing access. The company pioneered the “3D printing as a service” model, offering a platform where users could upload designs to be printed and shipped globally using industrial-grade equipment.

Early success metrics

- 2007–2015: Established marketplace model with over 1 million users

- 2016–2020: Expanded to multiple materials and technologies

- Peak operations: Processing thousands of orders monthly

- Global reach: Served customers in over 100 countries

The business model innovation

Shapeways’ original value proposition was notable for its time:

Platform advantages

- No upfront equipment investment for users

- Access to industrial-grade 3D printers

- Multiple materials and technologies

- Global shipping and fulfillment

- Design marketplace and community

Technical capabilities

- SLS (Selective Laser Sintering)

- SLA (Stereolithography)

- Metal 3D printing (DMLS)

- Full-color printing

- Professional finishing services

Financial Challenges and Market Pressures

The SPAC merger and public market reality

Stock performance analysis

- January 2021: $83.60 per share (SPAC peak)

- December 2021: $12.45 per share (−85%)

- December 2022: $4.20 per share (−95%)

- February 2024: $1.94 per share (−98%)

Source: financial market data

Revenue challenges

- Slowing growth vs projections

- Negative operating margins

- Expensive and inefficient customer acquisition

- Increased market saturation

Critical financial issues

- Unrealistic growth expectations vs manufacturing realities

- High cash burn exceeding revenue generation

- Inefficient capital allocation due to rapid scaling pressure

- Poor market timing amid tech stock downturn

Operational challenges and cost structure

Beyond financial pressures, Shapeways faced operational challenges that many service bureaus encounter.

Manufacturing constraints

- Equipment utilization and uptime

- Scaling quality assurance with volume

- Rising material costs

- Labor‑intensive post‑processing

Market dynamics

- Price competition and commoditization

- Customer expectations for speed and cost

- Continuous technology upgrades

- Logistics and shipping challenges

The Failed Rescue Attempt

In early 2024, a potential $5 million rescue bid was rejected, highlighting several critical issues:

- • Valuation Disconnect: Bid amount insufficient to address debt obligations

- • Strategic Misalignment: Potential acquirer's vision didn't match board expectations

- • Time Constraints: Limited runway for negotiating better terms

- • Stakeholder Conflicts: Competing interests between creditors and shareholders

Industry Impact and Market Analysis

What this means for the 3D printing industry

Company‑specific issues vs sector trends must be distinguished.

Industry concerns

- Market consolidation pressures

- SPAC risks for manufacturing companies

- Platform‑model sustainability

- Competition from in‑house capabilities

Positive indicators

- Continued growth in additive adoption

- Success of specialized service providers

- Technology advancement and cost reduction

- New application areas emerging

Why Some 3D Printing Companies Are Thriving

Sustainable business models

Diversification

- Multiple manufacturing technologies

- Broad material portfolio

- Various industry verticals

- Hybrid manufacturing services

Quality focus

- Rigorous quality systems

- Industry certifications

- Consistent delivery times

- Customer satisfaction metrics

Strategic growth

- Incremental expansion

- Technology leadership

- Strategic acquisitions

- Long‑term vision

Technical excellence and specialization

Industry specialization

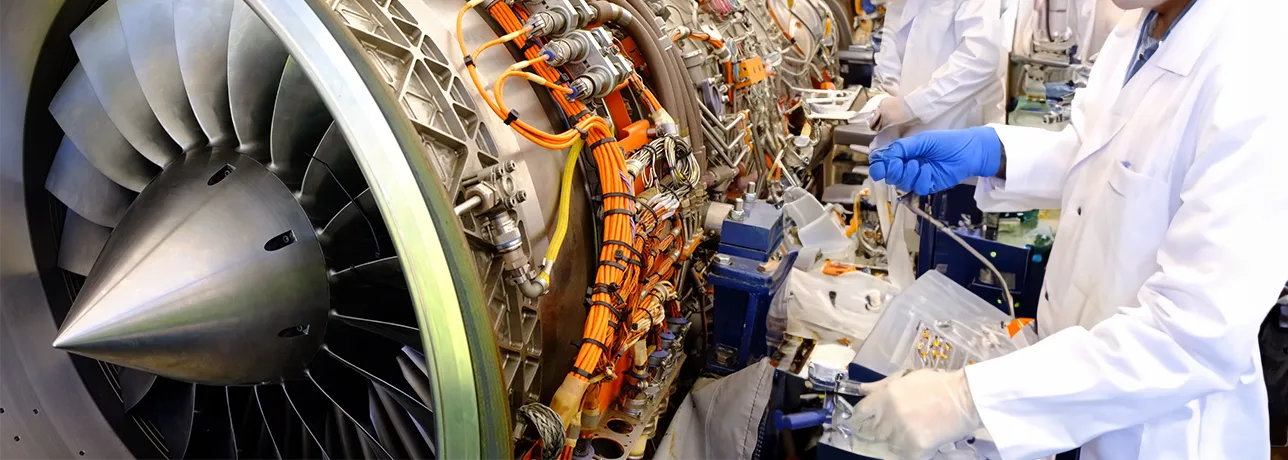

- Aerospace and defense focus

- Medical device expertise

- Automotive applications

- Electronics and consumer goods

Technology leadership

- Advanced material development

- Process optimization

- Quality assurance systems

- Design for additive manufacturing

Lessons for the Industry

Key takeaways for 3D printing companies

- Focus on sustainable growth over rapid scaling

- Build strong partnerships

- Specialize in specific industries or applications

- Invest in quality and operational excellence

- Maintain realistic financial expectations

- Diversify service offerings beyond basic 3D printing

Red flags to avoid

Financial pitfalls

- Over‑reliance on external funding

- Unrealistic growth projections

- High cash burn rates

- Inadequate working capital

Operational risks

- Overexpansion without market demand

- Neglecting quality for volume

- Insufficient operational efficiency

- Lack of competitive differentiation

Future Outlook for Additive Manufacturing Services

Market trends and opportunities

Despite Shapeways’ challenges, the industry shows strong fundamentals and growth potential.

Growth drivers

- Increasing adoption in production applications

- New materials and technology capabilities

- Supply chain localization trends

- Sustainability and waste reduction focus

- Mass customization demand

Market evolution

- Industry consolidation and specialization

- Integration with traditional manufacturing

- AI and automation implementation

- Hybrid manufacturing solutions

- Digital manufacturing platforms

Investment and strategic considerations

- Market research: Understand target markets and customer needs

- Business model validation: Test unit economics before scaling

- Technology investment: Balance innovation and operational stability

- Partnership strategy: Consider alliances over standalone expansion

- Financial planning: Maintain capital reserves for volatility

Conclusion

Shapeways' bankruptcy represents a significant moment in the 3D printing industry, but it should not be viewed as an indictment of the sector as a whole. Instead, it serves as a valuable case study in the importance of sustainable business practices, realistic growth expectations, and the need for strong operational fundamentals.

The companies that continue to thrive in the additive manufacturing space are those that have focused on building sustainable, profitable businesses rather than chasing rapid growth at any cost. They have invested in quality, developed deep industry expertise, and built strong customer relationships based on reliability and performance.

As the industry continues to evolve, the lessons learned from Shapeways' experience will help shape a more mature and sustainable approach to additive manufacturing services. Companies that prioritize operational excellence, financial discipline, and strategic partnerships will be well-positioned to capitalize on the significant opportunities that lie ahead.